Equipment Tax Credits for Primary Residences

- Arianne Large

- Mar 9, 2021

- 1 min read

Updated: Mar 7, 2022

Did you make improvements to your existing principal residence? Some of them may qualify for federal tax credits and incentives. The Non-Business Energy Property Tax Credits have been retroactively extended from 12/31/17 through 12/31/21.

Equipment Tax Credits for Primary Residences

Tax Credit: 10% of cost up to $500 or a specific amount from $50-$300

Expires: December 31, 2021

Details: Must be an existing home and your principal residence. New construction and rentals do not apply.

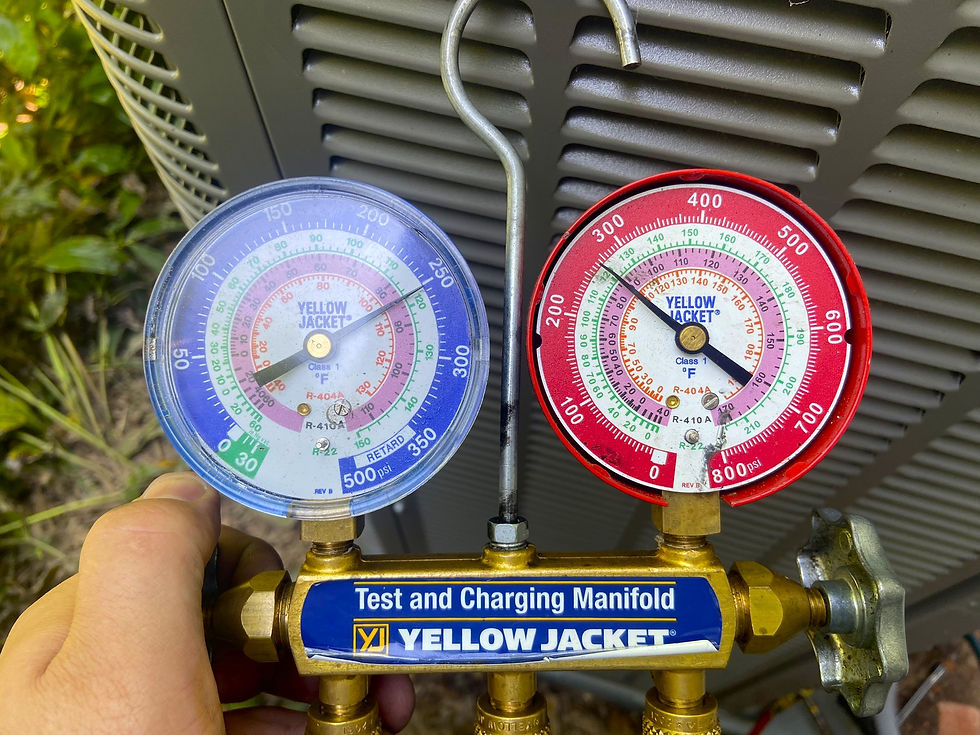

Air Source Heat Pumps: $300

Central Air Conditioning: $300

Gas, Propane or Oil Furnaces: $150

ADDITIONAL RESOURCES:

*The tax credit information is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service (IRS).